Cable Product Announcement: Transaction Assurance

We're thrilled to unveil Cable's latest product – Transaction Assurance, a pioneering solution and a revolutionary step toward setting the new standard for transaction effectiveness testing.

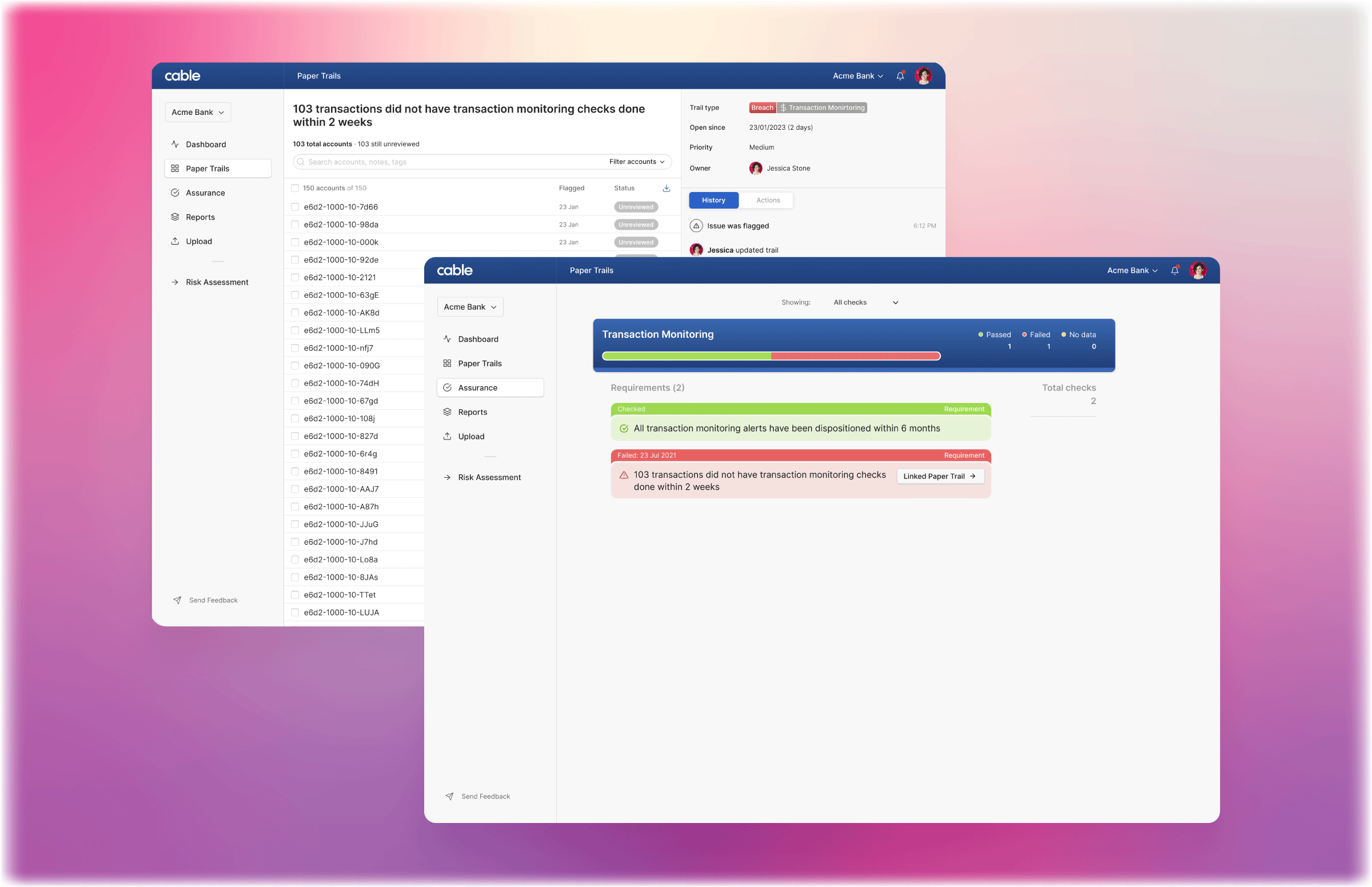

Distinct from traditional transaction monitoring, Cable’s Transaction Assurance automates the effectiveness testing of these systems, ensuring every transaction is not only monitored but also rigorously tested for any regulatory breaches or control failures, thereby eliminating the limitations of manual dip sampling.

Why Transaction Assurance?

In recent years, the financial industry has faced mounting compliance challenges, highlighted by billions of dollars in fines levied against major banks and crypto exchanges for anti-money laundering (AML) failures. These cases have brought to light, critical gaps in existing transaction testing protocol – minimal coverage due to manual sample testing, lack of scalability as transaction volume grows, and data gaps in reconciling transaction data across businesses and partners.

“These industry shortcomings bring to light the systemic gaps in manual testing. This is why we developed Transaction Assurance, it helps illuminate the vast, often untested expanse of transactional data, bringing that previously unseen 99% into sharp focus.” – Natasha Vernier, Founder and CEO, Cable.

With Transaction Assurance, we're eliminating the guesswork and inefficiencies associated with manual transaction testing. Our innovative technology offers real-time testing and validation, providing compliance assurance for each transaction to help ensure control effectiveness and adherence to transaction monitoring regulations, sanctions screening, Suspicious Activity Reporting (SARs), and Travel Rule compliance.

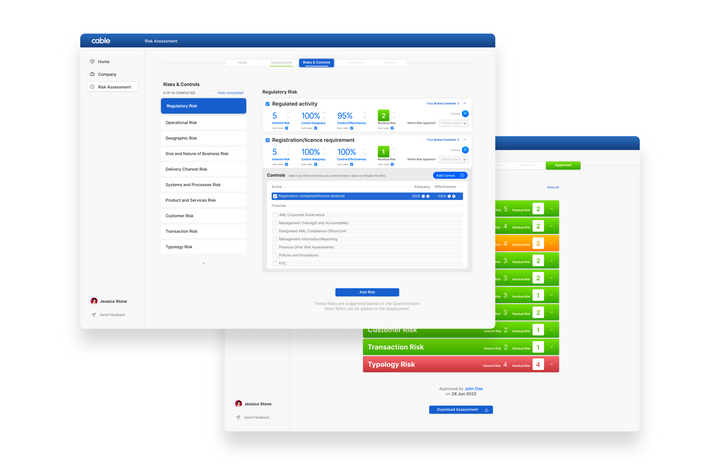

How it Works

Transaction Assurance seamlessly integrates with your existing transaction monitoring systems, providing a translation layer that continuously and automatically tests every transaction.

Our assurance engine, proactively tests, analyzes, identifies, and flags potential breaches and control failures as they arise. When anomalies are detected, the system immediately alerts your compliance team, allowing for swift resolution while minimizing remediation costs and time.

Key Benefits:

Recent Enforcement Actions & Consent Orders Related to Transaction Monitoring

High-profile cases have repeatedly exposed critical gaps and consequences in existing transaction monitoring systems. Most recently, Binance, the world’s largest cryptocurrency exchange, faced a historic $4.3 billion fine for AML, unlicensed money transmitting, and sanctions violations, including failure to prevent transactions in sanctioned jurisdictions and ineffective transaction monitoring. This case, among others in years past, underscores the importance of effective transaction testing:

- Danske Bank: Penalized €1.82 million for not monitoring high-risk customer transactions due to outdated data filters. [1]

- BNP Paribas: Fined €15 million for flawed transaction-monitoring protocols, failing to address risks associated with specific financial products and client types. [2]

- HSBC: Incurred an $85 million fine for AML failings, including inadequate monitoring and poor risk assessment. [3]

- Santander: Fined over £107.7 million for ineffective AML systems and failure to monitor unusual money flows. [4]

- Shinhan Bank America: Faced a $15 million penalty from FinCEN for failing to maintain an effective AML program and delayed SARs filings. [5]

These cases demonstrate the critical need for comprehensive transaction effectiveness testing, as a means to help prevent breaches and safeguard institutions from costly enforcement actions.

Interested in seeing Transaction Assurance in action? Chat with our team today or schedule a product demo for a deeper look at how Automated Effectiveness Testing can transform your organization’s risk & compliance program.