Ramp Network Transforms Financial Crime Risk Management

Leveraging dynamic automation and always-on financial crime control testing

Industries: Cryptocurrency, Fintech

Cable Solutions: Automated Assurance

Ramp, an FCA-registered crypto asset business, focuses on bridging the traditional fiat world with web3 and crypto economies, to make this connection as seamless as possible for both partners and customers. Their drive to innovate is rooted in compliance, ensuring they meet regulations and stakeholder confidence at every turn.

The Challenge

From its inception, Ramp prioritized a compliance-first approach, knowing the pitfalls of retrospective testing and remediation.

Ramp faced unique challenges inherent to the crypto economy, as they grew, they faced the monumental task of ensuring their compliance program met the highest standards of quality and efficacy – but manual quality checks and risk assessments were resource-intensive and prone to errors.

Initially, their compliance coverage was around 1%, managed through laborious manual processes, spreadsheets, and ad hoc communications.

A key objective for Ramp was to adopt a scalable testing solution that could grow with the company, circumventing extensive remediation work common in the industry. They aimed to demonstrate unwavering adherence to regulations and build trust among stakeholders, partners, and customers in an industry often seen as rule-averse.

The balance between customer service and regulatory compliance was delicate and crucial. James Dalton, Senior Regulatory Compliance Manager and DMLRO puts it succinctly "We have to find a seamless balance between servicing good customers and keeping out the bad guys.”

Moreover, the manual dip sample testing was limited and sporadic, covering only a fraction of total accounts, which made comprehensive oversight nearly impossible.

The Solution:

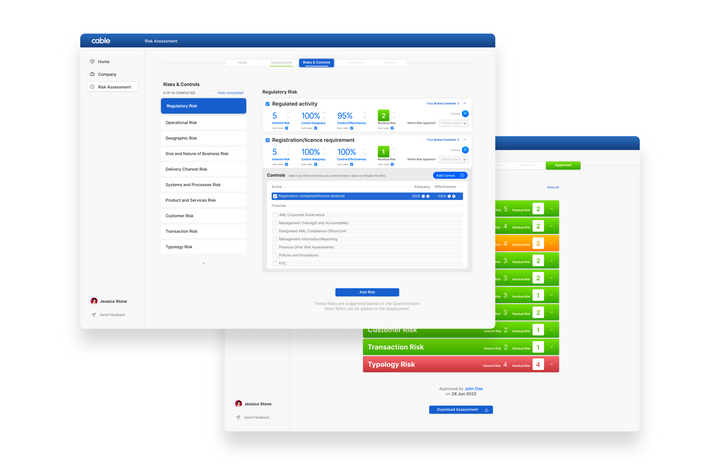

Ramp sought a partner that could adapt to their unique business model and scale alongside them. Ramp Networks deployed Cable’s Automated Assurance tools to enhance their quality checks, which now automatically verify data integrity, freeing up human resources for more strategic tasks.

Ramp's partnership with Cable transformed their compliance and assurance processes from a traditional dip sampling method to a proactive, automated system that ensures "100% compliance testing," as Steven Eisenhauer, Chief Risk and Compliance Officer emphasizes, and provided Ramp’s compliance team with greater certainty and the ability to identify and control issues promptly, avoiding the escalation of problems and extensive customer account remediation.

Cable became a pivotal tool, allowing for a streamlined and secure communication flow between team members, and fostering a collaborative line of communication that was both efficient and reliable. This shift allowed the compliance team to transition from being perceived as a cost center to being a fundamental part of Ramp's strategic operations, preventing problems and preempting regulatory scrutiny before they become unmanageable issues.

The Outcome

The results of implementing Cable's solutions were dramatic, the adoption of these technologies not only addressed the immediate challenges but also positioned Ramp Networks as a forward-thinking leader in risk management.

James noted that Automated Assurance led to significant operational efficiencies, including a reduction in manual processing time, while also meaningfully cutting down the time required to onboard new partners from weeks to just days. James noted that this shift in compliance testing gave the team the freedom to add more value to the business and enabled prioritization of the product team's resources.

Cable’s technology enabled Ramp to identify areas for improvement in its compliance program, which would have likely been missed with traditional dip sampling. This real-time testing approach meant that any issues impacted only a small number of accounts, preventing large-scale remediation projects.

Looking to maximize your compliance team’s productivity and have complete control assurance, while saving time and money? Get in touch here to learn more about Cable or schedule a demo to see Cable’s platform in action.