New Innovation, New Supervision: Unpacking the Fed's Novel Activities Supervision Program

On August 8, 2023, the Fed announced its new Novel Activities Supervision Program. Bank-fintech relationships were targeted as a key area of increased supervisory focus.

We recently hosted a webinar featuring leaders from Grasshopper Bank, Midland States Bank, and Coastal Community Bank, who broke down the Fed’s announcement and provided numerous actionable insights.

One of our expert panelists, Jeff Ketelhut, Head of Financial Crimes Governance at Coastal Community Bank, explained how BaaS banks and fintechs are likely to be impacted:

“The power has really switched to the banks, and I think this guidance really puts that power squarely with the banks . . . . Every BaaS bank claims to have turned down many more opportunities than they actually board, but this could really become even more prevalent under this exam approach.”

BaaS has easily been one of the most talked-about regulatory priorities in the last year. Notable enforcement actions and regulatory pronouncements make it clear just how vital compliance is to the success of any BaaS program.

Check out what the experts are saying about how to succeed in today’s BaaS landscape by listening to our webinar today!

Fill in your information below to receive a recording of our webinar!

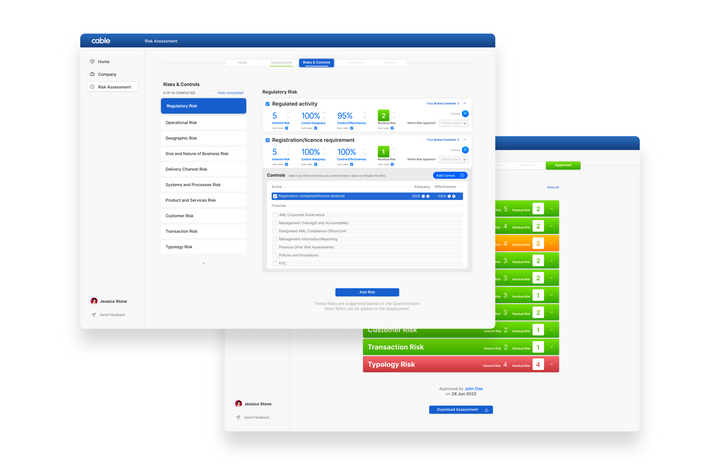

Cable is the all-in-one effectiveness testing platform that helps you comply with your financial crime requirements.