Key Implications of New US Beneficial Ownership Reporting Rule

The US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) recently published its long-awaited final rule setting out new landmark US beneficial ownership information (BOI) reporting requirements.

Once the new rule becomes effective, over 30 million legal entities created or operating in the US will be required to report BOI to a centralized government database.

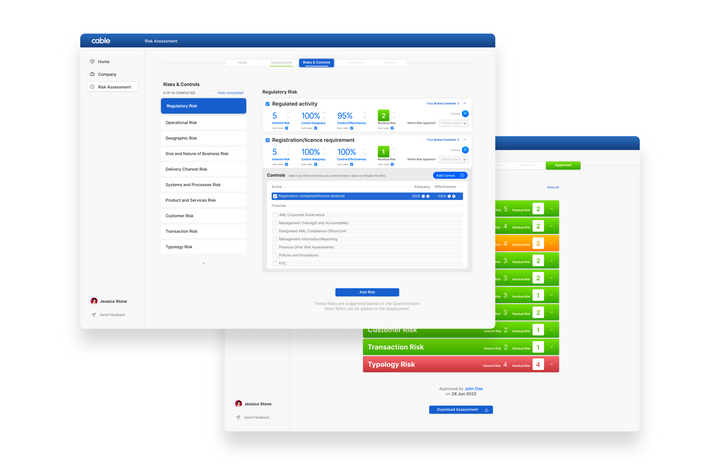

For compliance leaders, new policies, procedures, and controls will need to be put in place to ensure their organization can comply with this rule.

The US’s lack of federal BOI reporting requirements has been described by the Financial Action Task Force (FATF) as a “serious deficiency” in the US AML regime. But with this rule, the US will be equipped to “more effectively combat financial crime,” according to Treasury Secretary Yellen.

Key Dates

- January 1, 2024: The rule becomes effective and entities created or registered after this date have 30 days to file their BOI reports.

- January 1, 2025: Entities created or registered before January 1, 2024 have until January 1, 2025 to file initial BOI reports.

The rule’s implementation dates will be dependent on FinCEN funding, and may be adjusted.

Who Will Have to Report?

“Reporting entities” required to report BOI information include:

- US entities created by filing a document with a secretary of state or similar office under the law of a state or Indian tribe (which does not apply to many sole proprietorships, certain types of trusts, and general partnerships); or

- Non-US entities registered to do business within the US by the filing of a document with a secretary of state or similar office under the law of a state or Indian tribe.

However, the rule also exempts 23 entity types from BOI reporting requirements.

Notable exemptions include:

- Publicly traded companies;

- Banks and bank holding companies;

- FinCEN-registered money services businesses;

- Various SEC or CFTC-registered entities

- Operating companies with over 20 full-time employees, annual gross receipts or sales over $5 million, and an operating presence at a physical office in the United States.

What BOI Must Be Reported?

Reporting companies will be required to report BOI information that covers:

- Beneficial owners - this includes all individuals who, directly or indirectly, exercise “substantial control” over a reporting company, or own or control at least 25% of the ownership interests.

- Company applicants - this includes the individual who directly files the document creating or registering a reporting company, and the individual primarily responsible for directing or controlling such filing.

- The reporting company - this includes name, address, jurisdiction of formation and/or registration, and tax identification number.

Individuals and reporting companies will also be able to get a unique FinCEN identifier number. This number can be given to and used by other reporting companies as a substitute for providing the required BOI information to FinCEN.

Next Steps for Companies

Companies will only be penalized for willful violations of the rule, rather than inadvertent errors while acting diligently and in good faith.

But with just over a year before the rule becomes effective, compliance leaders need to act now to ensure their organization will be compliant with these new reporting requirements, including taking the following steps:

First, determine if any entities in your organization are not “reporting companies” required to report BOI information or qualify for one of the 23 specific exemptions.

Second, develop policies and procedures to:

- Identify if new entities are required to report BOI to FinCEN

- Confirm entities’ reporting/non-reporting status

- Collect BOI for all reporting companies

- File BOI reports timely

- Confirm information reported to FinCEN

- Update or correct information reported to FinCEN within applicable time periods

Finally, keep watch for:

- Two further rules to be issued by FinCEN on (1) access to and disclosure of BOI and (2) revisions to the 2018 CDD rule’s beneficial ownership provisions

- Anticipated FinCEN guidance, forms, and instructions regarding this rule and the other forthcoming rules