What we can learn from the FCA’s warning to challenger banks

Last week, the FCA levied criticism at UK challenger banks about the general state of their financial crime controls. But while the FCA directed its warnings at challenger banks and their customer growth trends, in many ways, what the FCA has said about challenger banks is important and relevant for banks and fintechs of all types.

What were the issues identified at challenger banks?

The FCA focused particularly on the financial crime risks related to challenger banks’ relatively easier and faster account opening processes and rapid customer growth. The FCA’s Executive Director for Markets, Sarah Pritchard, warned, “[T]here cannot be a trade-off between quick and easy account opening and robust financial crime controls.” As is true for any institution, it is critical to ensure that as your customer base grows, your financial crime controls grow as well. However, some of the banks assessed by the FCA did not update their financial crime program at the same pace as their customer growth.

But when it comes to the particular types of issues identified by the FCA…perhaps it would be better to ask what wasn’t covered in some way! The FCA cited a number of examples of banks failing to ensure full compliance with – or neglecting entirely – basic financial crime control requirements, such as customer due diligence, enhanced due diligence or customer risk assessment obligations. As a result, a common theme was that the challenger banks were not collecting enough information to adequately assess or manage the financial crime risk of their customers.

What’s the takeaway for all compliance officers?

Even outside of the UK, challenger banks have certainly had financial crime control breakdowns, as we wrote about recently. But it’s not just challenger banks that face these same issues.

Banks and fintechs of all shapes and sizes are competing fiercely for customers and introducing new, innovative products and services at a rapid pace. Each of these institutions faces the same challenge of ensuring their financial crime controls are tailored and scaled appropriately to changes in their customer base or products. The FCA even noted there are “limited differences in the inherent financial crime risks” of challenger banks relative to traditional banks. And it’s evident that non-challenger banks have had their fair share of financial crime control failures.

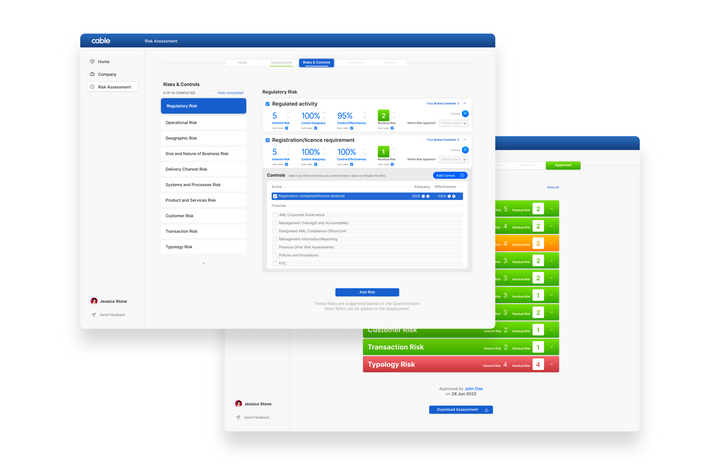

Fundamentally, whether you may be a challenger bank, a traditional financial institution, a fintech, or a crypto firm, the all-important task of ensuring the effectiveness of your financial crime controls in the face of an increasingly fraught financial crime landscape is a difficult task for which there is no good solution, absent automated financial crime assurance like that provided by Cable. Nonetheless, UK regulators are and will remain intent on ensuring firms improve the effectiveness of their financial crime controls.

All that said, if you are a fast-growing bank or fintech, regulatory scrutiny is clearly oriented in your direction. You cannot assume that because you may not be operating at the same scale as a traditional financial institution, the regulators won’t pay as much attention to you or will be slower to use their supervision or enforcement powers. The FCA’s latest report should put that view squarely to rest. Instead, ensuring you are fully attending to your financial crime compliance obligations needs to be a central focus.