We've raised $5.3m from CRV, LocalGlobe, and a diverse group of exceptional angels

I am delighted to let you know that Cable has raised $5.3m in seed funding, to help us towards our mission of reducing financial crime in the world. The round was led by CRV and LocalGlobe, with participation from Anthemis, and a number of highly respected angel investors and industry experts.

Reducing financial crime is not a small mission, and we knew that in order to achieve it, we would need to start as we mean to go on. Therefore, I am particularly proud that with this funding, we have maintained a diverse cap table to ensure that as we build Cable, we hear diverse opinions and feedback from as many different backgrounds as possible.

Cable’s Mission

Cable’s mission is to reduce financial crime in the world. The equivalent of 2-5% of GDP is money laundered every year, which equates to more than $4 trillion today. Even more astounding is that the best estimates say we catch less than 1% of that.

Financial crime impacts everybody everyday. At the most horrifying end of the scale, we know that 4 in every 1000 people are in modern slavery. And for those of us who are fortunate enough not to be impacted by human trafficking, sexual exploitation and forced labour, our taxes are higher because of corrupt governments. By stopping more financial crime and reducing the power that organised crime groups have, we can improve the lives of those most impacted by their atrocities, and also, hopefully, everyone else as well.

First Steps

Tackling the massive problem of financial crime is going to be a long process. To get started, we are solving one of the last completely manual areas in financial crime compliance.

At a high level, there are two requirements that regulated financial institutions (I'll just say "banks" from now on, for ease) have with regards to financial crime. The first is to identify risks and build controls to mitigate those risks. That is where identity verification, screening for sanctions, and transaction monitoring come in. There are some really great technology companies who have automated these processes, and we are lucky enough to have some of their founders as angel investors - Laura Spiekerman from Alloy and Charlie Delingpole from ComplyAdvantage.

The second requirement is to independently test that those controls work, which today is done entirely manually by large internal testing teams or external consultants. When I was at Monzo, I saw this first hand. The team I led was building financial crime controls, and we had many engineers and data analysts, and spent millions on technology. But the compliance team that was testing our controls had no engineers, no data analysts and no technology to help them (it is worth noting that I left in April 2020 and this might well have changed since.) This team would manually review 10 accounts a month, and spend a huge amount on external consultants who would manually review 100 accounts a year. And this is exactly how independent testing is done at all banks.

Given how easy it is for a fintech or bank to onboard a customer, and how many customers are being onboarded daily by some of the fastest growing fintechs, it’s startling that the only way to know if the controls to stop financial crime are working is to dip sample 10 accounts a month. It is no wonder that every fintech and bank we speak to has at least one expensive financial crime related remediation project going on.

At Cable, we believe that this dichotomy between how the two sides of financial crime compliance are treated is why banks are so ineffective - 99% ineffective - at stopping financial crime. We believe that banks are ineffective at stopping crime because they don’t know how effective they are. And if you don’t know how good you are at something, it is basically impossible to get any better.

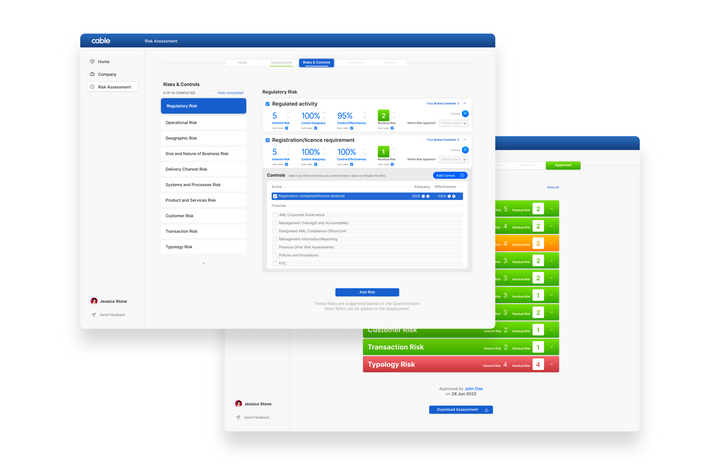

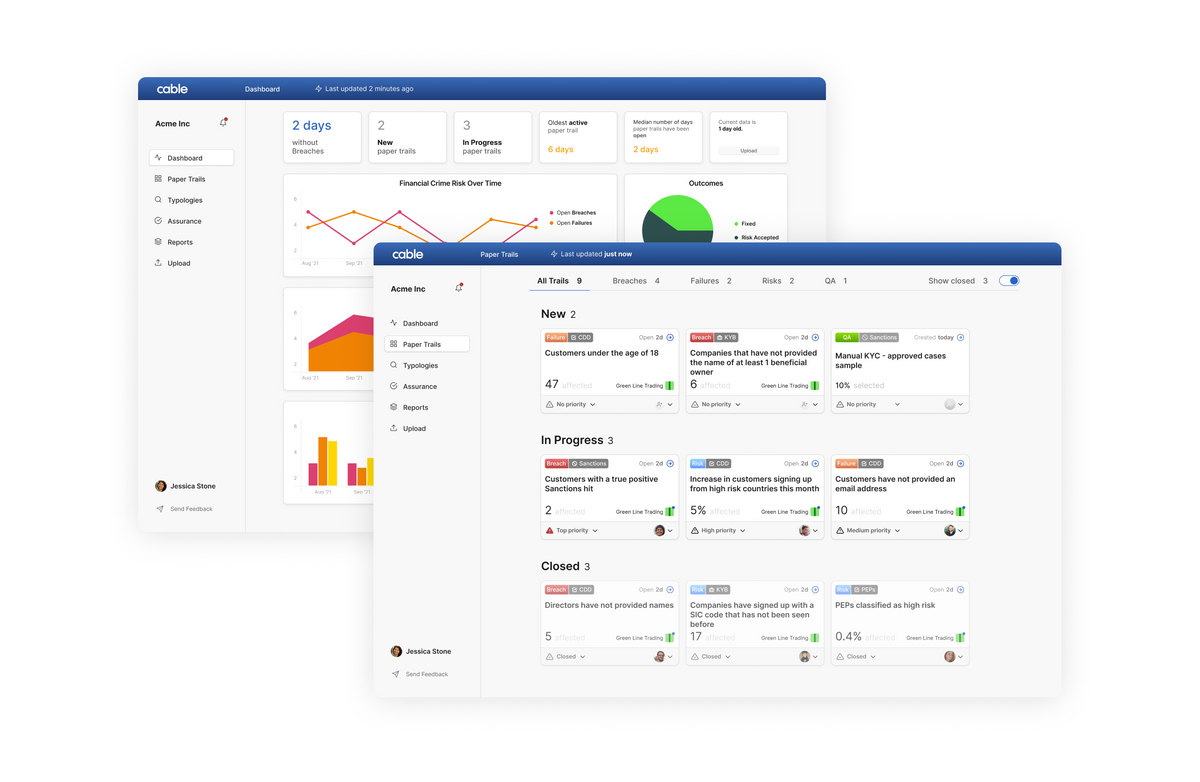

So, we have automated this independent testing of controls. We enable banks and fintechs to know in real time if they are compliant with financial crime regulations and if their controls are working as expected. We want to turn compliance officers into growth enablers by giving them the same level of insight and technology as their colleagues.

We call this automated financial crime assurance.

Building the Right Culture

We have a lofty mission, and if we are going to achieve it, we’ll need to build multiple products over multiple years, in many different industries - financial crime does not just happen at banks. And if we are going to do that, we need to build a team of dedicated financial crime fighters who get what they want and need from a workplace, and feel fulfilled every day.

We have written a lot about our Operating System before. It really is how we work at Cable, and the team recently told us that it matters to them almost more than our mission. That wasn’t our intent, but it isn’t a bad outcome!

Going Forward

When we started Cable we had the idea to automate independent testing of financial crime controls, but we had no idea if it would work. In 2021 we built an embarrassingly sparse MVP and tested it with some of the top fintechs in the UK, US and Latin America. We discovered that automated financial crime assurance works, and makes a whole tonne of sense. Wouldn’t you rather know about a failure in your controls today, instead of in 6 months time when you’ll need to spend millions in operational costs to remediate it? We also discovered that there are lots of areas of low hanging fruit where compliance officers have been ignored by technology. As we say, compliance officers are the true superheroes, and we are building the first technology focussed on solving just their needs.

Towards the end of last year we put some polish on the product, built an API, and worked hard on the nuts and bolts that make the Cable product work behind the scenes. And so today, with this funding announcement, we are excited to start working with our first contracted customers, and push forward with our mission to reduce financial crime in the world.

There is a long, long way to go. But we are a team of mission driven, passionate, financial crime fighters, and we know what we have to do.