OCC Penalties Will Focus More on Identifying and Fixing Issues

The OCC recently released revisions to its Civil Money Penalties (CMP) manual, effective January 1, 2023. The CMP manual guides how the regulator considers aggravating and mitigating factors when assessing potential fines.

The key takeaways from these changes are that the OCC will:

1. Place significantly more weight on 2 new mitigating factors, namely:

- Whether an institution self-identified issues before notice from a regulator or law enforcement, and

- Whether an institution proactively remediated the root cause of any issue

2. Consider business restrictions such as limiting growth, as a core part of penalties

3. Have more discretion to levy bigger fines with new CMP tiers

Below, we summarize the OCC’s thinking behind these changes, and how Cable can help you be in the best position to respond.

The OCC’s mitigating factors place more weight on identifying and remediating issues

The OCC recognizes two new, more heavily weighted mitigating factors of “Self-identification” and “Remediation/Corrective Action.” These replace the previous factors of “Good faith before notification” and “Full cooperation after notification.”

Full credit for these factors requires the following:

- Self-identification: "A practice is considered self-identified when the bank discovers the deficiency or conduct without prompting from a regulatory or law enforcement agency and alerts the OCC to the existence of the conduct or deficiency in a timely manner. . . . To receive full credit under this factor, the bank must take proactive steps to further investigate like conduct or deficiencies in other parts of the bank, as applicable."

- Remediation/Corrective Action: “To receive full credit, the bank must proactively remediate the root cause of the conduct or deficiency from an operational and risk management standpoint, and the bank must also remediate like conduct or deficiencies.”

The OCC also added language indicating that penalties for BSA violations and other unquantifiable public harms will be based on the violations’ scope and severity - this reinforces the importance of finding and remediating issues as fast as possible.

The OCC may use business restrictions, such as limiting growth, as part of a penalty

The OCC's revisions make clear that it may use growth and business restrictions, such as those imposed on Blue Ridge Bank, to penalize institutions that have widespread or systemic issues or fail to remediate issues in a timely manner.

Simply put, compliance investments can make or break an institution's ability to survive and scale.

“The OCC will consider coupling any CMP against an institution with injunctive relief, such as business restrictions, pursuant to 12 USC 1818(b)(6), when appropriate. Such coupled relief may be appropriate when, for example, the institution has failed to make effective or sustainable progress on corrective actions despite a prior enforcement action or CMP assessment or has widespread or systemic deficiencies that require curtailing growth or expansion into new products or services. The combined impact of the CMP and business restrictions may be considered when determining the CMP amount.”

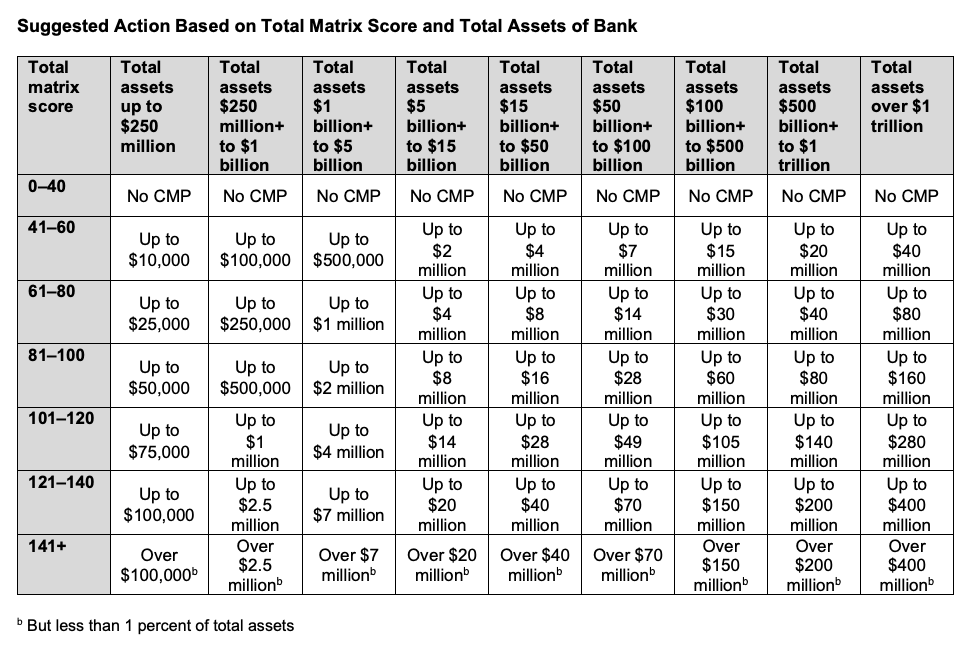

The OCC’s CMP matrix added more tiers and increased suggested penalties

Finally, the OCC revised its suggested penalties table (see below) to include 9 tiers, as opposed to 7.

The upper tier is now much greater at over $1 trillion total assets, instead of over $100 billion, and the highest suggested penalty threshold has also increased to over $400 million instead of over $150 million.

How Cable Can Help You Respond

Contact us here today to learn more or see Cable's platform in action.