Financial Crime Predictions for 2023

What will the financial crime landscape look like in 2023?

We spoke with industry experts at Alloy, Alloy Labs, Fintech Business Weekly, Griffin, and Treasury Prime to learn what next year holds in store.

With the rapid pace of regulatory change, compliance teams need to be ready for what is coming and invest in the tools they need to succeed.

Here's a preview of the predictions for 2023 covered in our full report, across financial crime regulation, compliance trends, compliance programs, and enforcement:

- Bank-fintech relationships are in the spotlight

- More crypto rules to come forth

- Increasing access to beneficial ownership information

- Sanctions developments will demand close attention

- Compliance teams will need to do more with less

- Compliance will be a competitive advantage

- Fraud and identity theft are on the rise

- Sanctions landscape will remain fraught with risks

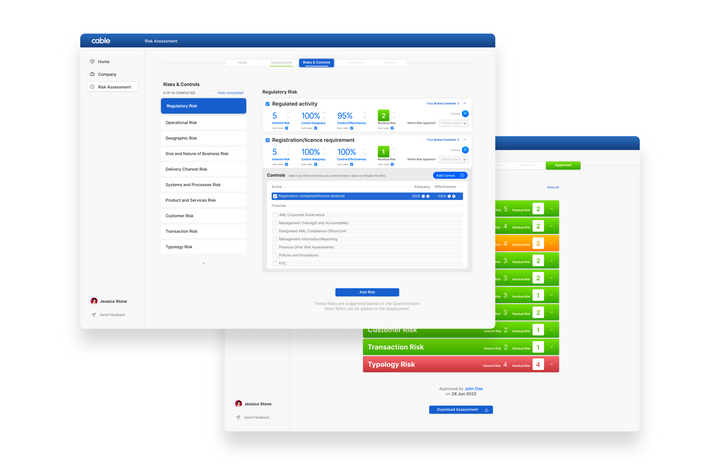

- Demonstrating compliance program effectiveness through automation

- Improving identity verification technology and processes

- Enforcement likely to be more active as regulators work through past issues

- Ineffective compliance programs invite potential actions

Download our report now to learn what the experts are saying!

Cable is the complete effectiveness testing platform for financial crime compliance and oversight. Contact us here to learn more about Cable or to see our platform in action.