Cable Product Announcement: Financial Crime Risk Assessment

We’re excited to announce the launch of Cable’s Financial Crime Risk Assessment – the first automatically updating risk assessment solution empowering compliance leaders to grow and protect their businesses.

Financial crime risk assessments are critical to regulatory compliance and business growth decisions. But the vast majority of firms still rely on entirely manual processes, evaluations, and spreadsheets.

At Cable, we’re thrilled to introduce Cable’s Financial Crime Risk Assessment, an advanced, automated solution transforming how firms do risk assessments.

Compliance leaders no longer have to feel as though they are sticking a finger in the air with risk assessments. Our new tool, alongside Cable’s Automated Assurance product, lets firms not only detect any regulatory breaches and control failures in real time using Cable’s platform, but also automatically update their risk assessment’s control efficacy and residual risk ratings to reflect exactly how well their controls are operating.

Additionally, Cable’s Financial Crime Risk Assessment enables partner banks and BaaS platforms to onboard, assess, and integrate fintech partners’ financial crime risks into their own risk assessments. With Cable’s suite of products, partner banks and BaaS platforms are fully equipped to satisfy intensifying regulatory expectations for bank-fintech oversight and risk management.

If you’re looking for a smarter, better way to gain risk insights to propel your business and compliance teams forward, Cable’s Financial Crime Risk Assessment is built for you.

Get in touch with us today here for a demo of Cable's Financial Crime Risk Assessment or to learn more about Cable’s complete effectiveness testing platform for financial crime compliance and oversight.

Key Benefits

How It Works

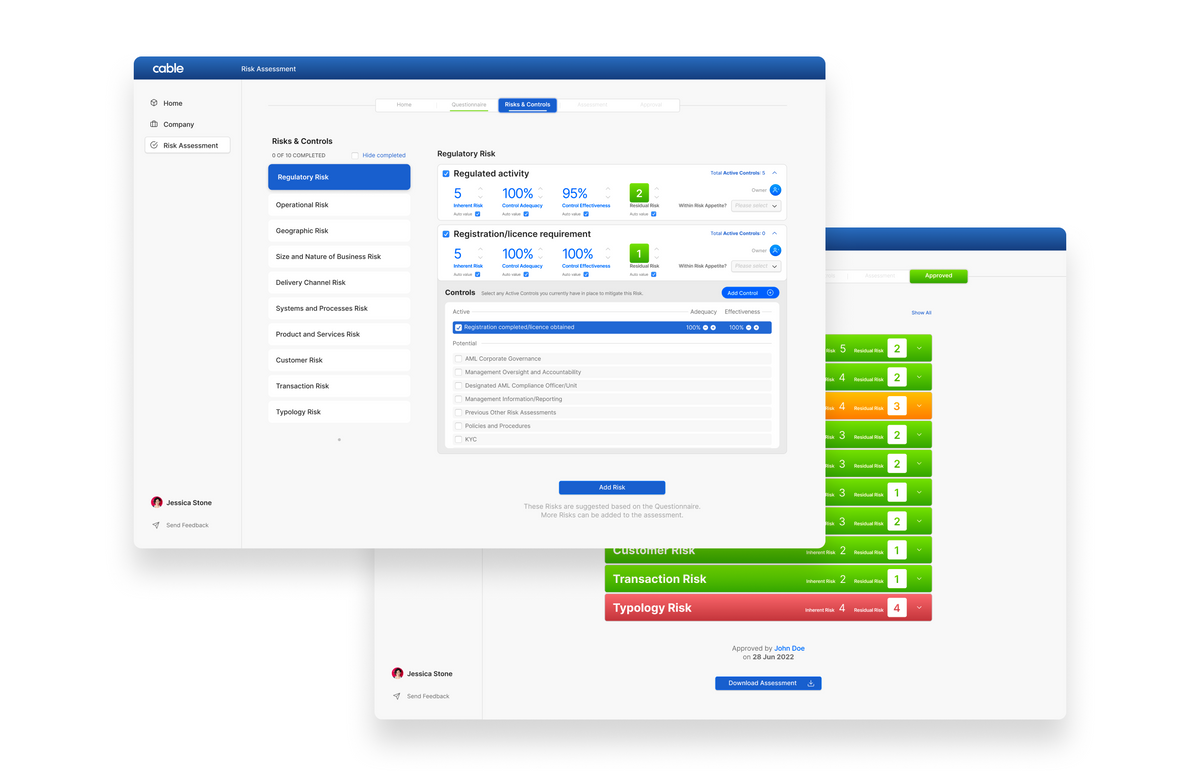

With an intuitive questionnaire process, automated integration of fintech partners’ risk assessments, advanced risk rating calculations, streamlined workflow and collaboration capabilities, and complete reporting features, compliance leaders are turning to Cable’s Financial Crime Risk Assessment to do more with their risk assessments than ever before.

Cable’s Financial Crime Risk Assessment is built on regulatory guidance, industry expertise, and customer feedback. It's user-friendly and optimized for delivering actionable insights.

At each step of the way, Cable provides auto-calculated risk scoring for inherent and residual risks, whilst ensuring all controls, risks, ratings and actions are also fully customizable by compliance leaders.

Once a firm’s risk assessment is finished, Cable’s platform provides centralized actions tracking, approval workflow, and reporting capabilities to enable compliance leaders to efficiently operationalize any risk assessment outcomes.

If you're interested in Cable’s Financial Crime Risk Assessment, reach out here today to schedule a demo or learn more information.