Building a Diverse Cap Table

Today we celebrate International Women’s Day. It’s a day to reflect on how far we have come as a society with more and more opportunities open for women, but also to understand that there is still much to do. A blog for another time, perhaps.

As I reflect on how times have changed in my working life, as a female, I naturally think about diversity as a whole.

We all understand why diversity and inclusion is important within the workforce, at least we should do. It is well documented that businesses perform exponentially better with a diverse workforce. McKinsey research shows that companies in the top quartile for gender diversity on executive teams are 25% more likely to have above-average profitability.

But one area that I don’t see as much focus on is how diversity can be increased across our cap tables and why it’s so important to do this.

On 17th February, we announced our seed funding of $5.3m. The funding is fantastic and enables us to really push our mission to reduce financial crime in the world forward. But, for us, what was equally as exciting was the achievement of a really diverse cap table.

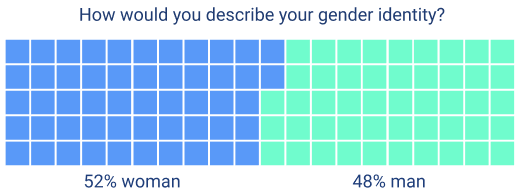

Gender Identity - more than 50% of our cap table identifies as a woman

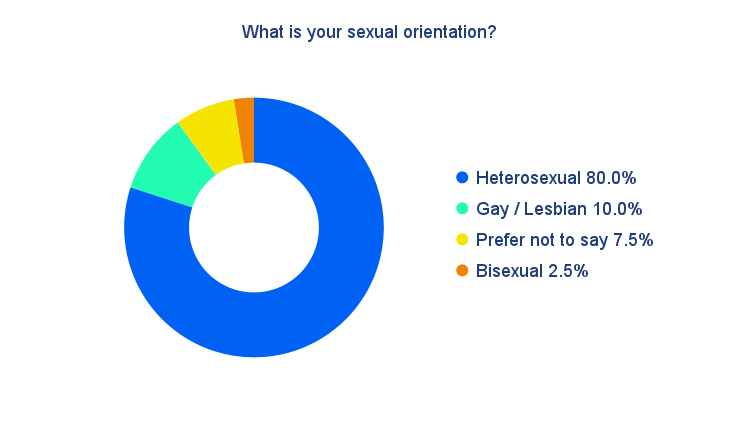

Sexual Orientation - more than 10% of our cap table identifies as LGBTQ+

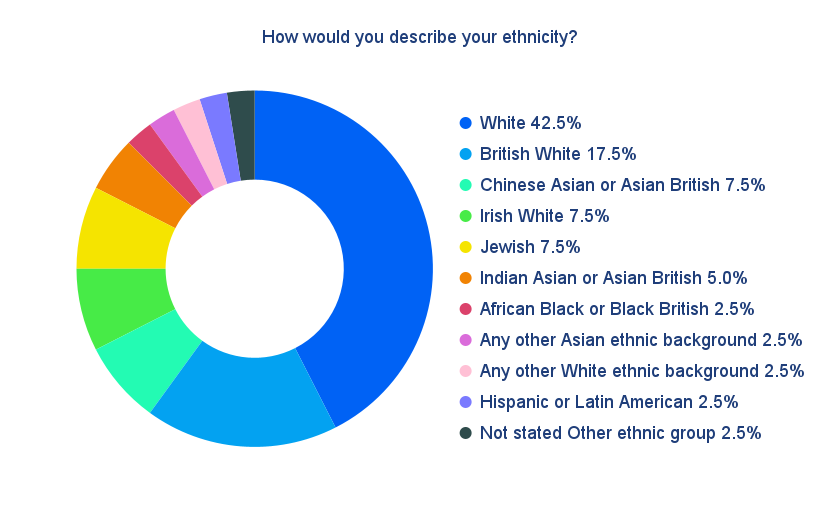

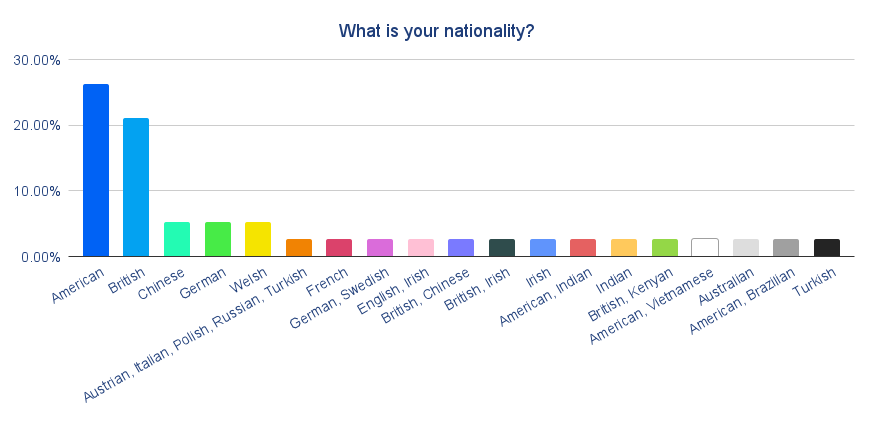

Nationality - 19 individual or combinations of nationalities are represented on our cap table

But Why do we Care?

Cable intentionally sought out a diverse cap table. It was extremely important that it represented a wide spectrum of society. But why?

The reasons are not so different as to why a diverse workforce is so critical:

Diversity of opinion improves business outcomes

By having a group of people who come from different backgrounds, you also have a group of people who represent different perspectives. This gives you a holistic view of your market and can therefore give you a competitive edge.

It’s important as a founder to have your views and beliefs challenged. The best way to do that is to have investors and advisors who are different to you and can provide a more complete picture.

A Harvard Business Review article found that if you have investment partners with the same educational background the success rate of acquisitions and IPOs was 11.5% lower than those with diverse educational backgrounds. It also shows that the effect of diverse ethnicity increases the comparative success by 32.2%, and that companies with female investors have a 9.7% increased chance of a more profitable exit.

Diversity begets more diversity

If you start with a diverse group of investors and advisors it’s easy to attract more diversity. Inevitably doors will be opened to more diverse groups through their networks.

This is incredibly important especially when it comes to hiring within your company and being introduced to other advisors. According to Glassdoor’s 2020 Diversity Hiring Survey, more than 3 out of 4 job seekers and employees say that a diverse workforce is an important factor when evaluating companies and job offers.

To change the investor landscape

It’s no secret that the majority of investors are from well represented groups. It is really hard for those in underrepresented groups to break into the investment world but it’s so important that it happens, not just for the reasons above, but also to create opportunities. Crunchbase tells us that a staggering 65% of US VC firms have no female partners.

By committing to a diverse cap table you are helping to redefine this balance.

How to Build a Diverse Cap Table

First and foremost, you have to make it a priority. It can be easy to write off building a diverse cap table because it’s “too hard” or “takes too long”, especially if you find yourself under time pressure. Whilst preparation is key, it is simply not true to say that there are not enough diverse investors out there, that they don’t have relevant experience, or that they are too hard to find.

From our experience at Cable, these are some ways to ensure you can build a diverse cap table:

- Be clear about your intentions to build a diverse cap table when talking to VCs. You might get introduced to their female partners, and they may have networks of angel investors that they can introduce you to.

- Prepare well in advance. Start talking to diverse angel investors 4-5 months before kicking off the fundraising process.

- Network. Ask diverse VCs and angels for intros to other diverse investors.

- Understand the numbers. How many investors do you want to come from underrepresented groups? It’s absolutely ok to say “no” to white men to keep a seat available for a diverse investor.

- Keep a low barrier to entry when it comes to the amount of investment. If you are taking on a first time investor, they may want to write small checks. Our smallest angel check was $2,500, but the angels who wrote those checks have been just as proactive and valuable as those that wrote bigger checks.

- Understand what technical expertise you want to bring to your cap table. In Cable’s case, we were predominantly after marketing, go-to-market and product experience, and found plenty of diverse angels that met those criteria.

In Conclusion

If you are committed to a diverse workplace then it’s critical that you also think about having a diverse cap table. It’s not hard to do - there are plenty of fantastic angels from diverse backgrounds ready and waiting to add their advice and experience to your project.

At Cable it’s important that our choice of investors and advisors reflects what we stand for and brings a wide range of perspectives and beliefs. Running a business can often feel like a constant flow of decision making and problem solving, and having investors and advisors that can meaningfully help is crucial. We are really proud that we’ve achieved such diversity, and intend to maintain this during future funding rounds.

And of course, if you want more information on how we achieved this, please feel free to reach out to us.